Repayment: Funds are withdrawn from the checking account about the date Brigit establishes being your up coming payday.

Payment processing companiesPayroll & HR softwareE-commerce softwareMarketing softwareBusiness insuranceBusiness lawful

Simply how much can I borrow which has a Cash Advance from Advance The united states? The utmost total it is possible to borrow which has a Cash Advance is regulated by condition regulation. Your current revenue may even ascertain simply how much you qualify for within just that range.

With a wide array of US associates, leading lenders, compliance with condition and federal regulations, and the usage of field very best tactics, our Particular service ensures pro lending providers from trusted associates.

Employer-based advances may demand fees, but they are generally lessen than cash advance application costs and employers may perhaps deal with them. Acquired wage accessibility businesses consider up to a couple of days to supply funds, which happens to be on par with cash advance applications.

Card advice quizTravel rewards and perksEarn cash backPay down debtMake a major purchaseGet your approval odds

A Cash Advance is a fast and effortless way to get money to the spot after you will need it most. This kind of shorter-expression loan is on the market in tiny greenback amounts you pay out again in complete on your own up coming payday.

Take a look at far more cost savings accountsBest high-produce financial savings accountsBest price savings accountsSavings account alternativesSavings calculator

Brigit features small cash advances, and its quick-funding payment is very low compared to other cash advance apps. The app is also transparent with customers about what they can perform to get accredited for larger sized advances.

Late payment service fees differ by lender. Set reminders to stay away from penalties, and phone your lender for aid with late payments. one Lender Alternatives

Varo also money all advances quickly, and that is a far more prevalent supplying from financial institutions that require borrowers to be examining account prospects than standalone cash advance applications.

While the advance fee could be significant, Varo’s flat-rate pricing could possibly be much easier to navigate for borrowers wanting to assess the advance’s read more Price up front. Most cash advance apps cost rapid-funding fees according to the advance volume and frequently don’t publicize the dimensions.

Higher rapidly funding expenses and the various steps to getting a tiny advance causes it to be a a lot less-than-ideal quick-cash alternative.

Obtain your no cost credit rating scoreCredit card basicsApplying for any credit score cardChoosing a credit cardManaging charge card debtCredit card methods

Might be more cost-effective than an overdraft cost: Should your preference is among a paycheck advance and spending an overdraft charge, the advance is likely more cost-effective. Numerous app expenses can be under $10 (with out a idea), while bank overdraft charges might be nearly $35.

Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Tina Louise Then & Now!

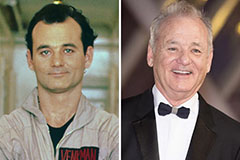

Tina Louise Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!